The foundation of any thriving economy is not the government treasury — it’s the disposable income of the people. Yet, too often, governments forget this simple truth. Disposable income is what allows ordinary citizens to save, invest, and spend, creating a cycle of economic growth that benefits everyone. Without it, even the richest government treasury is meaningless if the people themselves are unable to participate in the economy.

When people have money left over after paying for essentials, several things happen:

Savings grow: Money saved in banks becomes capital for loans. Entrepreneurs and small business owners can access these loans to expand operations, hire more people, and innovate. In this way, your savings are not just your safety net — they fuel the dreams of countless Nigerians striving to build businesses.

Purchasing power drives production: When citizens have money to spend, they buy goods and services. This demand encourages businesses to produce more, hire more staff, and improve infrastructure. It’s a self-reinforcing cycle: the more people can spend, the more the economy grows.

Investment multiplies wealth: Disposable income enables citizens to invest in businesses, education, and assets. These investments create long-term wealth for families and communities, strengthening the nation from the ground up.

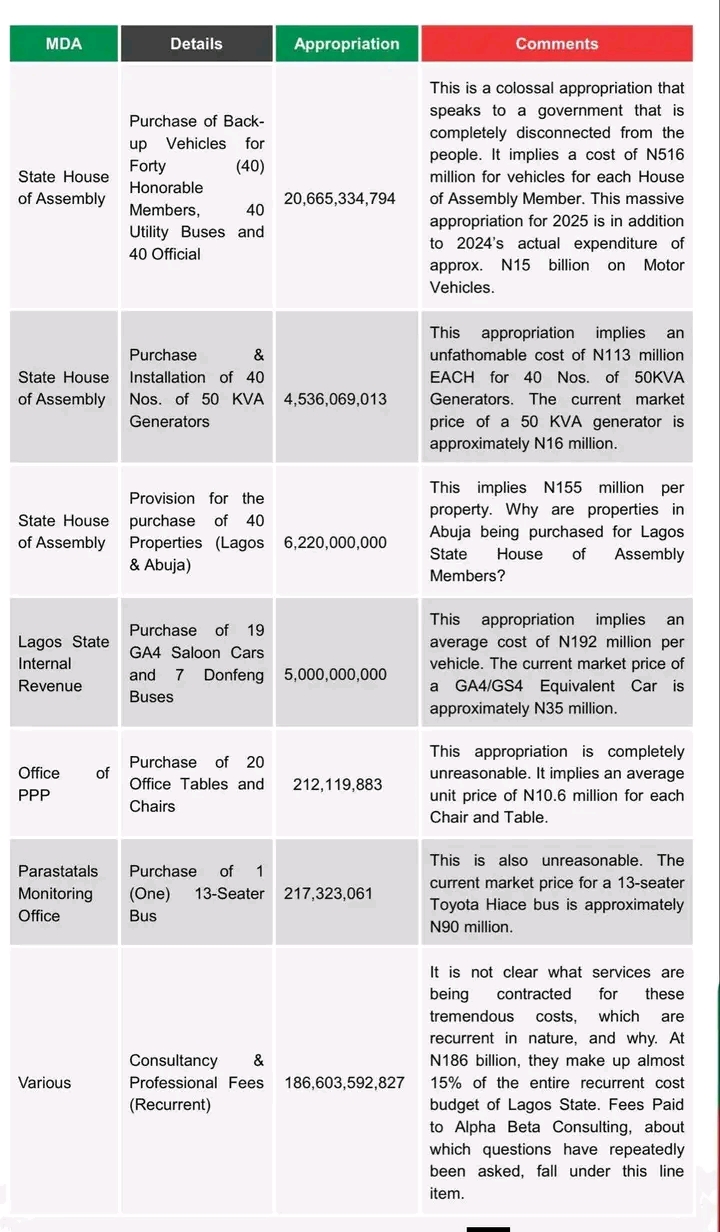

Excessive or poorly implemented taxation breaks this cycle. By taking too much of people’s money, the government reduces savings, limits spending, and stifles investment. Worse, when these funds are funneled into corruption, waste, or inefficient government projects, the people see little return for the wealth they’ve sacrificed.

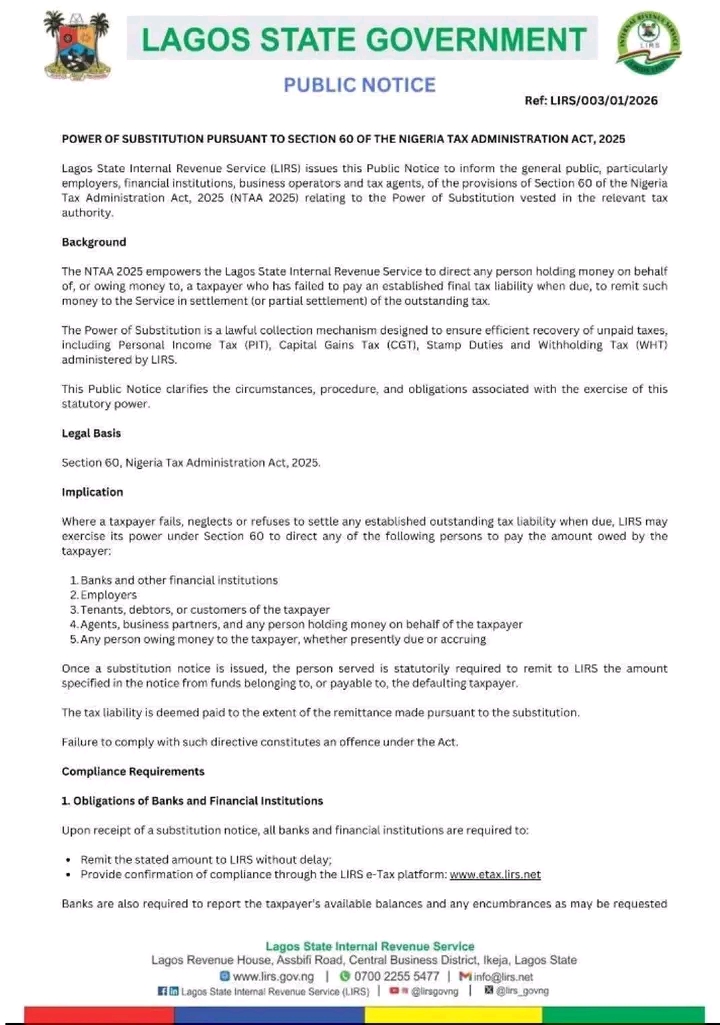

Now, Lagos State has proposed policies that could forcefully take money from people’s bank accounts. This is not just taxation — it is an attack on economic freedom. Many Nigerians may not fully realize the consequences:

Money taken from banks is money that can no longer be saved, spent, or invested by the people.

Funds may be mismanaged or lost to bureaucracy and corruption, providing little tangible benefit to citizens.

The policy undermines confidence in the banking system, discouraging both savings and entrepreneurial activity.

Historically, Nigerians have fought back against such economic overreach. The Ojota Rally is a perfect example: citizens collectively resisted policies that threatened their financial freedom, showing that organized action can make a difference. If such resistance is not repeated today, we risk allowing our money — and our freedom — to be stripped away without a fight.

Make no mistake: this is not merely a financial issue. It is a question of freedom, dignity, and control over our own lives. Most slaves are kept against their will, but here, we are being asked to surrender our money willingly, under the guise of legality. By standing idly by, we allow ourselves to become complicit in our own economic oppression.

The reality is simple: our money is our power. It is what enables us to save, to invest, to buy, and to grow. Policies that strip that power away do more than reduce bank balances — they weaken families, discourage entrepreneurship, and threaten the future prosperity of the nation.

It is time for Nigerians to wake up and reclaim control over their finances. It is time to demand policies that empower the people, not enrich politicians. And it is time to remember that an economy is not built by filling a government treasury — it is built by the people who generate, spend, and invest wealth every single day.

Our money. Our choice. Our freedom.

Published by Chuks Nwachuku