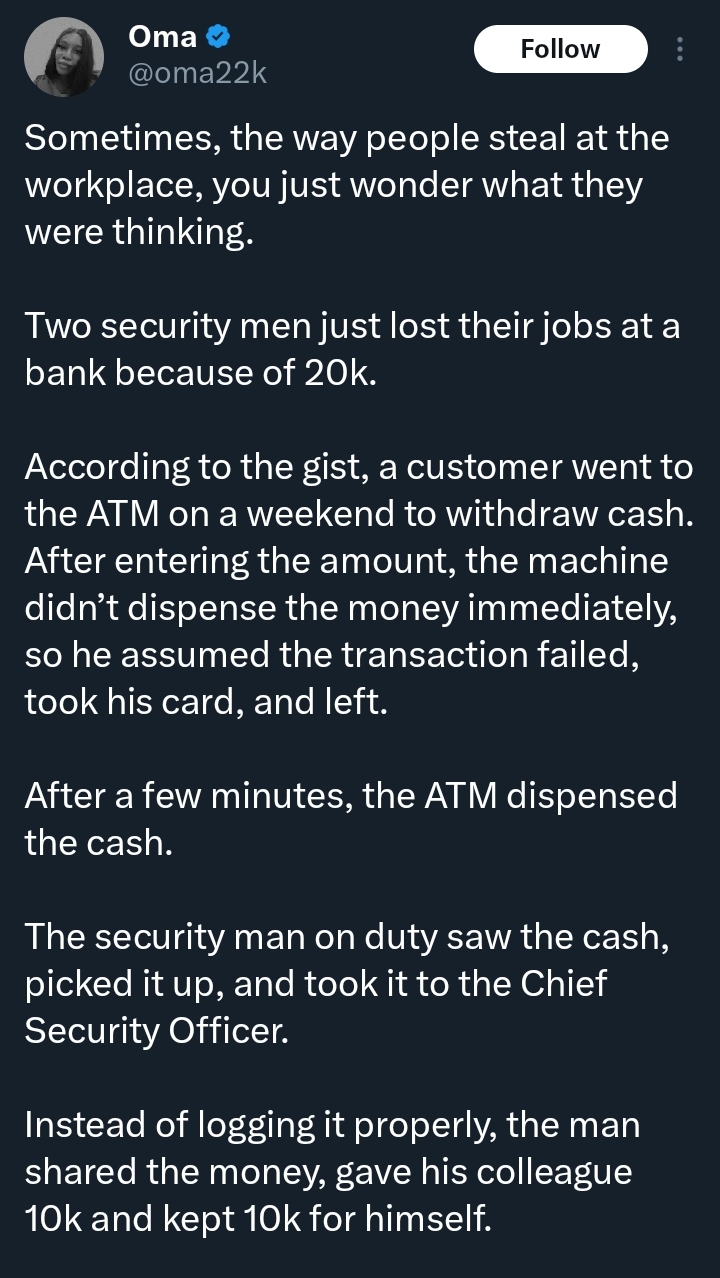

Two security guards have reportedly lost their jobs at a commercial bank after allegedly sharing ₦20,000 mistakenly dispensed by an ATM machine.

The incident, which surfaced in a post on X (formerly Twitter), has sparked widespread debate about workplace ethics and the consequences of dishonesty.

How It Happened

According to the account shared online, a customer visited the bank’s ATM over the weekend to withdraw cash. After inputting the withdrawal amount, the machine reportedly delayed before dispensing the money.

Assuming the transaction had failed, the customer removed his card and left the premises.

Moments later, the ATM dispensed the ₦20,000.

The security guard on duty allegedly noticed the cash and picked it up. Instead of documenting it as unclaimed funds in line with standard banking procedures, he reportedly handed it over to the Chief Security Officer.

Rather than logging the money or escalating it to management, the officer was said to have split the cash — giving ₦10,000 to his colleague and keeping ₦10,000 for himself.

CCTV Review Changes Everything

Days later, the customer realized his account had been debited despite not receiving the cash. Convinced he never collected the money, he returned to the bank to file a complaint.

Bank officials initially informed him that the ATM transaction was successful and that the cash had been dispensed.

However, the customer reportedly insisted he did not receive the money. His persistence prompted the bank manager to order a review of the CCTV footage covering the ATM area.

The footage allegedly revealed the security personnel picking up the cash shortly after it was dispensed.

Following an internal review, both men were reportedly dismissed from their positions.

Reactions Online

The story has generated strong reactions on social media.

- Some users expressed disbelief that anyone would risk steady employment over ₦20,000, describing the amount as “too small” to justify such consequences.

- Others pointed to economic hardship and low wages as possible factors influencing poor decisions.

- Many, however, stressed that integrity is especially critical in financial institutions where trust forms the foundation of operations.

The post concluded with a pointed message:

“If salary is not enough, overtime is never enough.”

For many observers, the takeaway was clear — a brief lapse in judgment can undo years of hard work and cost a stable source of livelihood.

Published by Ejoh Caleb