A Nigerian lawyer based in Dublin, Ireland, has sparked online discussions after revealing how much Access Bank charged her for transferring money to Nigeria, amid conversations around the country’s newly implemented tax policies.

The lady, identified as Barrister Bridget Nnenna, shared her experience in a Facebook post, detailing the charges deducted from two separate transactions she made on Thursday, January 1.

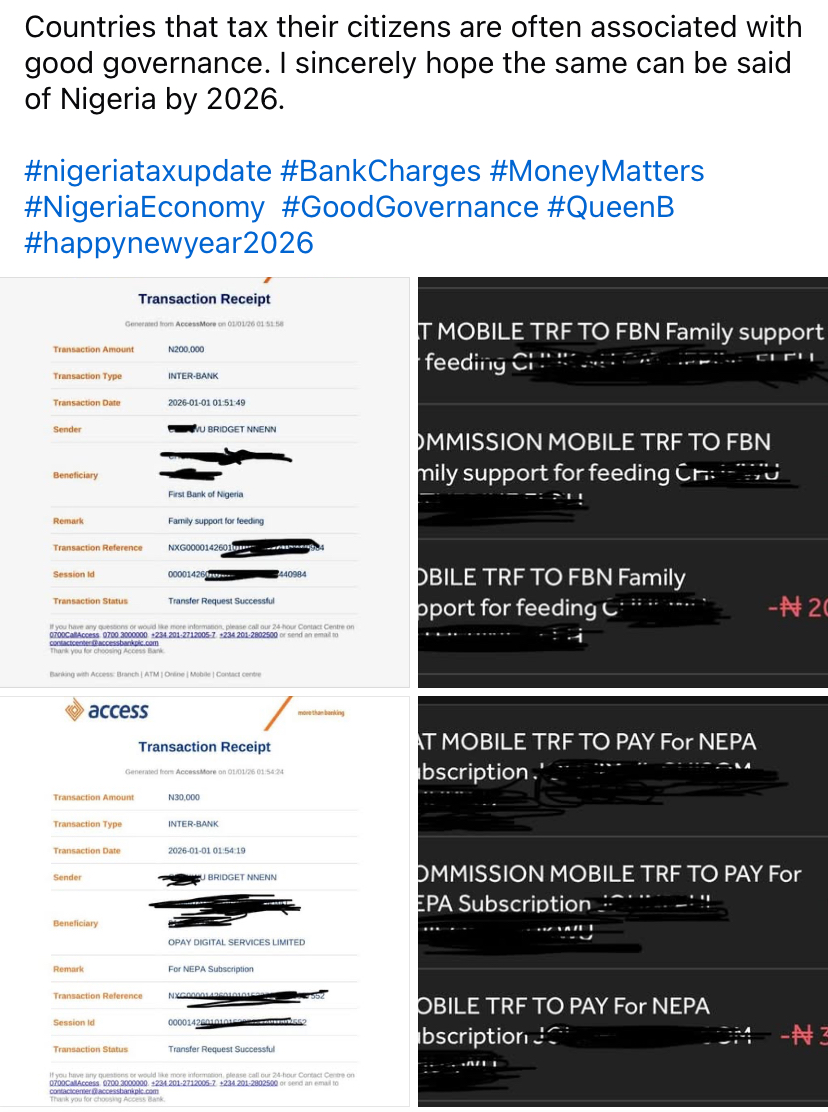

According to Bridget, she transferred ₦200,000 and ₦30,000 to Nigeria and was surprised by the deductions applied to each transfer. For the ₦200,000 transaction, Access Bank charged her ₦50 and ₦3.75, while the ₦30,000 transfer attracted charges of ₦25 and ₦1.88.

She also posted screenshots of the transaction receipts to back up her claims and help other Nigerians understand what they might be charged when making similar transfers.

Explaining the purpose of the transactions, Bridget said the ₦200,000 was sent as family support for feeding, while the ₦30,000 was meant for electricity (NEPA) subscription.

Bridget further disclosed that Access Bank had earlier informed her of a policy change, noting that bank charges would now be borne mainly by the sender rather than the receiver, in line with new banking and tax regulations.

Using the opportunity to comment on Nigeria’s broader tax system, the legal practitioner expressed cautious optimism that increased taxation could translate into tangible national development.

“Countries that tax their citizens are often associated with good governance. I sincerely hope the same can be said of Nigeria by 2026,” she wrote.

She added that she hopes the new tax policies would lead to better healthcare, improved infrastructure, access to basic amenities, and genuine efforts to reduce poverty and hunger across the country.

Social Media Reactions

Her post quickly gained traction online, with Nigerians debating the fairness of the charges, the impact of the new tax laws on everyday banking, and whether increased taxation would truly result in improved governance and public services.

See below;

Published by Ejoh Caleb