After a well-known mobile bank suspended his account, preventing him from accessing the ₦250,000 in his account, a Nigerian man has resorted to social media for assistance.

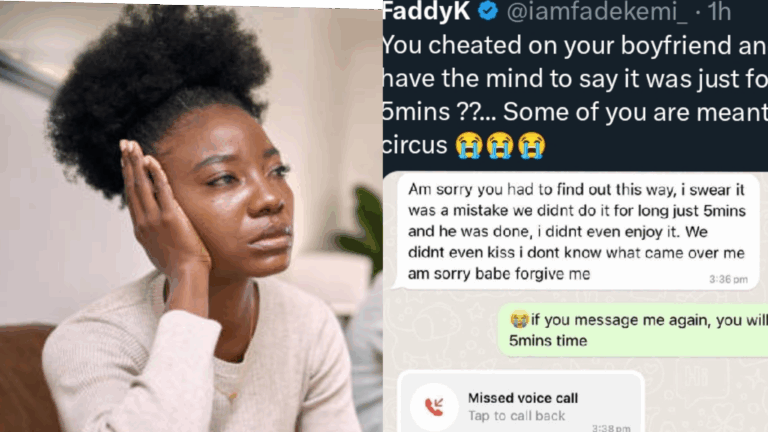

The POS service operator shared his experience on X (formerly Twitter), stating that he is now in debt to his clients.

According to his post, the trouble started when a ₦95,000 school fee payment was deposited into his account.

He attempted to transfer the money but received an error message, and the funds were locked in his suspended account.

The account was still inaccessible after numerous attempts to fix the problem, such as contacting customer service and providing the bank with the required identification documents.

The man stated that he was unsuccessful in his attempts to seek help from the Central Bank of Nigeria (CBN) and other organizations.

His full statement read:

“Dear Nigerians, I need your help. @palmpay_ng has mentally killed me. They suspended my account and asked me to visit @FIUNigeria office in Abuja if I want it reopened. I just returned from Abuja after a long trip, only to be shocked by what I found.”

“On December 2nd, 2024, I tried to make a transfer from my Palmpay account (registered number 8156932022) and was told ‘payer’s account has an issue, contact customer care for assistance.’ At the time, my balance was about ₦95,000, which was a school fee payment. I thought it was a network issue and waited. Hours later, the problem persisted.”

“After reaching out to customer care, I was repeatedly redirected to emails that were not responded to within 48 hours, and sometimes only on weekends. Despite following their instructions, including sending a selfie with my NIN, Palmpay did not resolve the issue.”

“Now, my account holds about ₦250,000, including the school fee and payments from POS customers. Palmpay continued to delay, asking me to visit NFIU, but they refused to unsuspend my account without NFIU’s involvement.”

“I visited the CBN branch in Lokoja, who advised me to contact NFIU. I also informed Palmpay of my visit to the CBN, but they insisted that only NFIU can lift the suspension. I am now at the NFIU office in Abuja, hoping to resolve this matter.”

“I’m sharing this for a few reasons:”

1. I’ve borrowed money from friends and family to cover school fees, and they need to be aware of the situation.

2. Financial issues related to NFIU and EFCC make me fear being wrongfully suspected.

3. I am now in debt, and I need to resolve this before the 31st of January.

“I will provide updates as soon as I can. The address Palmpay provided for NFIU was outdated, and I had to spend extra money to find the correct location.”

The post concluded with a request for support and a warning about potential consequences for his financial standing.

The man added that Palmpay had provided an old address for NFIU, causing further delays and costs.

WATCH VIDEO:

Published by Ejoh Caleb