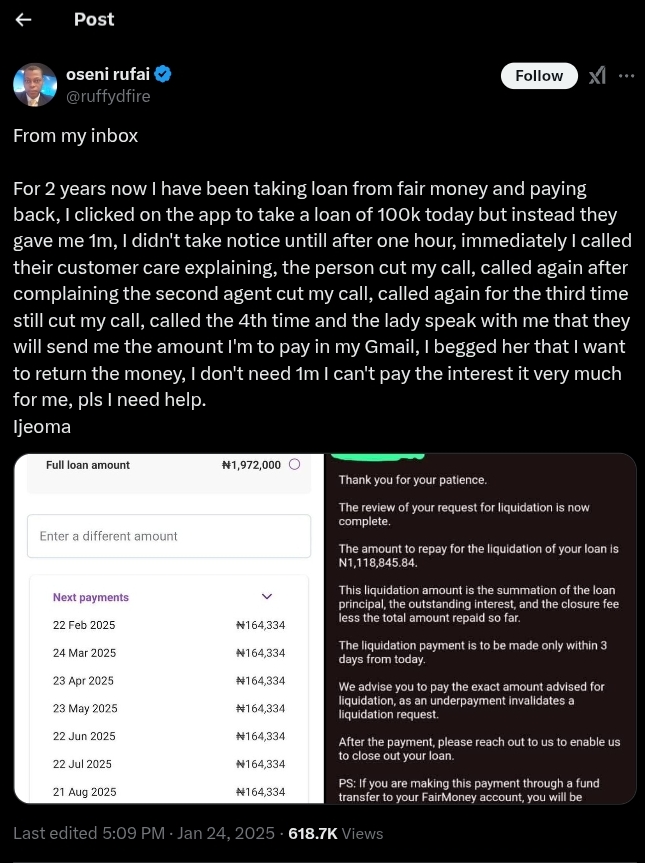

A Nigerian woman sought help after she accidentally received ₦1 million from a loan app instead of the ₦100,000 she had planned to borrow.

The woman said her calls were abruptly disconnected even though she had called customer service several times.

Nigerian journalist @ruffydfire posted the story on X (formerly Twitter) after the woman sent her a message describing her experience.

She had been a frequent borrower on the app for two years, and when she attempted to apply for ₦100,000, she was given ₦1 million instead.

She did not realize the difference until an hour later, at which point she promptly contacted customer service. But her phone calls kept getting dropped.

The woman’s message read: “For 2 years now, I’ve been taking loans from FairMoney and paying them back. Today, I clicked on the app to borrow ₦100,000, but instead, they gave me ₦1 million.”

“I didn’t notice until an hour later. When I called customer care, the first agent hung up on me. I called again, and the second agent also cut my call. On the third try, my call was cut again.”

“Finally, on the fourth call, a lady spoke to me and said they would send the correct repayment amount to my Gmail. I begged her to allow me to return the money because I don’t need ₦1 million and can’t afford the high interest. Please, I need help.”

The post quickly gained traction, with many concerned individuals commenting and expressing their thoughts.

See some reactions below:

@Atomic19721187: “When he discover that 1m was sent instead of 100k did she refund back 900k back or he spent the whole money? I think the right would ‘ve to refund the 900k and that would have saved the situation.”

@flourish007: “This country appears to be rife with opportunists and rogues. It seems they intentionally push people into unsustainable debt they can not repay. I often question the role of the CBN as a seemingly symbolic regulatory body.”

@elvisodese51: “That’s institutional scam, in a working legal system, gather your evidence and sue and demand for damages.”

@Bowman99516961: “Just send them a letter that you are declining the loan and if they don’t cancel it they will lose both principal and interest. On your letter give them 24 hours to cancel it or they lose everything.”

@owolabitaiwo: “I expect that you should know what to do. Well, just copy the central bank of Nigeria this action and further your complaints to them, boom!. They will undo everything. A colleague of mine was almost hoodwinked into the same act until we copied the CBN before they reverted.”

@proudlylegit: “Una get luck say na person wey get good heart una jam. Na sara of 1m una do ajeh, shey be una they find who to unalive with interest rate nii, oju iya yin a bo if na me, shey be una sabi curse person on phone, una go curse tire ajeh. Na federal government go intervene last last.”

SEE POST:

Published by Ejoh Caleb