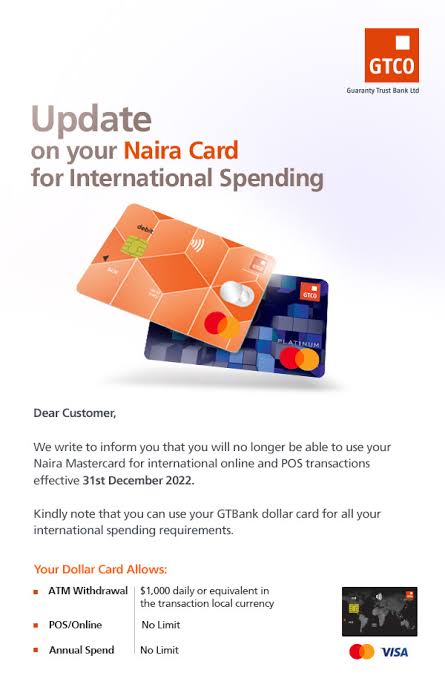

Guaranty Trust Bank has announced that its naira cards will no longer be used for international transactions starting December 31

This means customers using the GTBank mastercard can no longer use their naira debit cards to pay for transactions originated in foreign currency.

Nigerian Banks had in March reduced their monthly international spending limit on naira cards citing “current market realities on foreign exchange.”

The banks gradually reduced their monthly international spending limit on naira cards from $100/$120 to $50/$20.

In September, several banks suspended international transactions on naira cards. GTB announced its decision on Thursday.

Read Their Statement On The Email Inbox As Obtained By NaijaCover Below:

“Dear Customer, we write to inform you that you will no longer be able to use your Naira Mastercard for international online and POS transactions effective 31st December 2022. Kindly note that you can use your GTBank dollar card for all your international spending requirements,” the bank said in an emailed memo.

“According to the bank, the dollar card allows ATM Withdrawal of $1,000 daily or the equivalent in the transaction’s local currency. It added that with the dollar card, there is no limit to international PoS or online transactions. There will also be no annual spending limit,” it said.

Nigeria has suffered an importation-fuelled foreign exchange crisis for years, but the scarcity worsened in 2021 with its export proceeds declining amid increaed supply for foreign exchange. The dollar exchanges for naira at about 440 a dollar at the official market and N740 a dollar at the parallel market.

As of December 28, Nigeria’s foreign reserve fell to $37billion, compared to $37.1 billion recorded as of November 28.