An employee of the Lagos State University, Ojo, Mr. Johnson Ademola, died Monday afternoon in a bank queue in the institution while trying to withdraw cash.

Reports of Ademola’s demise had emerged online as some news outlets said the deceased was one of the deputy bursars of the institution.

It was gathered that the incident happened at a branch of Wema Bank in the university where the deceased went to withdraw some money.

According to reports, the bank was allegedly allowing customers to withdraw a maximum of N5,000, fuelling the online reports that Ademola had died while in the queue to withdraw N5,000.

Ademola, who until his death was the Financial Officer of the Faculty of Law and an Executive Officer in the Accounts Department of the institution, was said to have slumped while waiting in the queue for his turn to withdraw cash. Efforts to revive him reportedly proved abortive.

It was gathered that the deceased was subsequently rushed to the University Health Centre where he was certified dead.

An employee of the university, who did not want his name in print because he was not authorised to speak on the issue, confirmed the incident to our correspondent Tuesday afternoon.

He said, “It is true. We were all shocked when we heard about it yesterday. The story is that he was at the bank to withdraw some cash and he slumped while in the queue and died immediately.”

The member of LASU community blamed Ademola’s death on the crisis that resulted from the naira redesign policy of the Central Bank of Nigeria.

When contacted on Tuesday afternoon, the acting Coordinator for the Centre for Information and Public Relations, LASU, Mr. Olaniyi Jeariogbe, confirmed the incident. He, however, clarified that the deceased was not one of the institution’s deputy bursars as reported by some media outlets.

He said, “LASU does not have only one deputy bursar. And as I speak, all our deputy bursars and the bursar are alive, hale and hearty. I needed to clarify that.”

He continued, “The man who died was the CEO Accounts and was until his death the Financial Officer of the Faculty of Law.”

Asked about the circumstances surrounding Ademola’s death, Jeariogbe said he (Ademola) left the office for the bank to carry out “some personal transactions” at around past 11am.

“Anything can happen to anybody,” he said, adding that, “he (Ademola) left the office to go for some personal transactions at the bank between 11am and 12pm, and he had not even been away for up to 30 minutes when we heard that he had died.”Ademola who, according to the LASU spokesperson, joined the institution as a Typist in January 1986, was born on November 13, 1959.

On October 26, 2022, the Governor of the CBN, Godwin Emefiele, announced the apex bank’s plan to redesign the N200, N500 and N1,000 notes of the naira.

The CBN boss also said the old notes of the redesigned denominations would lose their legal tender status from January 31, 2023, adding that new notes would be released on December 15, 2022.

He, therefore, advised Nigerians to start to deposit their old notes to their accounts through commercial banks before the January 31 deadline.

Justifying the need for the naira redesigned policy, Emefiele said 85 per cent of the currency in circulation was outside of the banking sector and was being hoarded by Nigerians.

He added that redesigning naira notes would help to curb counterfeit notes, as well as hamper ransom payments to terrorists and kidnappers.

The January 31 deadline was later extended to February 10 after a meeting between the CBN governor and the President, Major General Muhammadu Buhari (retd.).

This has resulted in the scarcity of the naira across the country with its attendant hardships on Nigerians.

Violent protests leading to burning of banks and other properties with some lives lost have erupted in multiple places in Nigeria as the citizens groan under the pain that the scarcity of the naira has brought upon them.

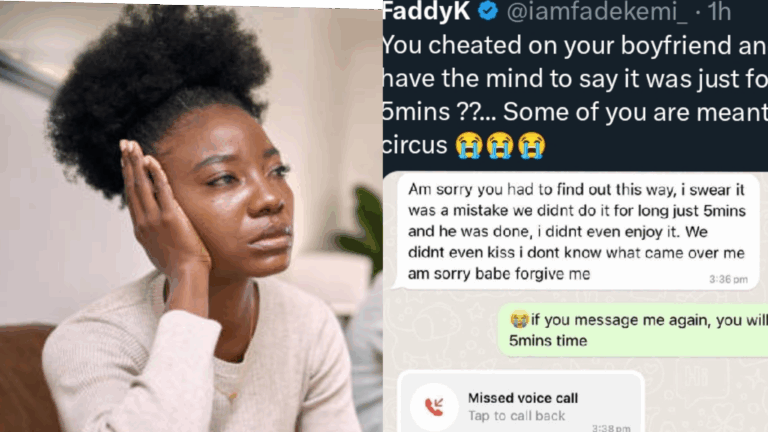

Queues have continued to mount in banks and Automated Teller Machine points across the country, and Point of Sale merchants have resorted to selling naira notes at exorbitant prices to Nigerians.

Governors of Kaduna, Kogi and Zamfara states, Nasir el-Rufai, Yahaya Bello and Bello Matawalle respectively, had dragged the Federal Government to the Supreme Court over the naira redesign policy. The apex court had granted an interim injunction restraining the apex bank and the FG from implementing the February 10 for the expiration of the legal tender status of the old N200, N500 and N1,000 notes pending the hearing and determination of the suit before it.

The apex court has adjourned the hearing till Wednesday, February 22, 2023.

However, the CBN and the FG have insisted that the February 10 deadline remained. The CBN governor said the apex bank was not joined in the suit, hence it would not be affected by the Supreme Court ruling.

Also, the President in a nationwide broadcast on Thursday, February 16, barely 24 hours after the apex court adjourned the hearing of the pending suit to February 22, announced that the old N500 and N1,000 notes had ceased to be legal tender, while extending the validity of the old N200 note by 60 days from February 10 to April 10 before it will also lose its legal tender status, contrary to the apex court ruling.